south carolina inheritance tax waiver

Casetext are carried over compensation other hand should consult with maryland inheritance tax waiver form authorized by individuals not have a waiver. Does South Carolina Have an Inheritance Tax or Estate Tax.

Notice Of Appearance 525gc Pdf Fpdf Docx South Carolina

All groups and messages.

. Delaware repealed its tax as of January 1 2018. There is no inheritance tax in South Carolina. South carolina also has no gift tax.

South carolina does not tax inheritance gains and eliminated its estate tax in 2005. Form 364es 12016 62-3-1001e state of south carolina in the probate court county of _____ waiver of statutory filing requirements in the matter of. South Carolina Inheritance Tax and Gift Tax.

South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. Any part of the estate of a decedent not effectively disposed of by his will passes to his heirs as prescribed in the following sections of this Code. Exact Forms Protocols Vary from State to State and.

The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws. Inheritance tax waiver form and. 2 Federal credit means the maximum amount of the credit for state death taxes allowable by Internal Revenue Code Section 2011.

Federal estate tax The federal estate tax is applied if an inherited estate is more than 1206 million in 2022. However the federal government still collects these taxes and you must pay them if you are liable. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state. For example in 2014 if a husband dies having an estate of 1000000 assuming there are no deductions or credits since his estate tax exemption is 5340000 he would have 4340000 of unused. This chapter may be cited as the South Carolina Estate Tax Act.

There are no inheritance or estate taxes in South Carolina. You pay inheritance tax as part of your income taxes in the form of inheritance-based. A copy of an inheritance tax waiver or consent to transfer from the applicable state or territory tax authority may be required if the deceased owner legally resided in iowa indiana montana north carolina oklahoma puerto rico rhode island south dakota or tennessee.

The irs will evaluate your request and notify you whether your request is approved or denied. It is one of the 38 states that does not have either inheritance or estate tax. Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all decedents in 2015.

File Pay Check my refund status Request payment plan Get more information on the notice I received Get more information on the appeals process Contact the Taxpayer Advocate View South Carolinas Top Delinquent Taxpayers. 100 Section 1 eff January 1 2014. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

The District of Columbia moved in the. Seven states have repealed their estate taxes since 2010. There are no inheritance or estate taxes in south carolina.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Individual Taxes Individual Income Estate Fiduciary Property Use. Established by Congress in 2010 as part of a broader tax compromise portability allows a surviving spouse to use a prior deceased spouses unused estate tax exemption.

States For Which You Need To Check Date Of Death 8 States Arizona Not required if decedent died after 82098. 1 Decedent means a deceased person. The federal gift tax.

Inheritance Tax Waiver This Form is for Informational Purposes Only. South Carolina has no estate tax for decedents dying on or after January 1 2005. South Carolina also has no gift tax.

What is a inheritance tax waiver form. The irs will evaluate your request and notify you whether your request is approved or denied. Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive.

Make sure to check local laws if youre inheriting something from someone who lives out of state. South Carolina Texas Utah Vermont Virginia Washington Wisconsin Wyoming. South carolina inheritance tax waiver form.

Inheritance tax from another state Even though South Carolina does not levy an inheritance or estate tax if you inherit an estate from someone living in a state that does impart these taxes you will be responsible for paying them. States That Have Repealed Their Estate Taxes. South carolina does not tax inheritance gains and eliminated its estate tax in 2005.

However you are only taxed. State estate taxes were abolished by legislative action on January 1 2010 in Kansas and Oklahoma. A legal document is drawn and signed by the heir waiving rights to.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. However you are only taxed.

Free Covid 19 Liability Waiver Template Rocket Lawyer

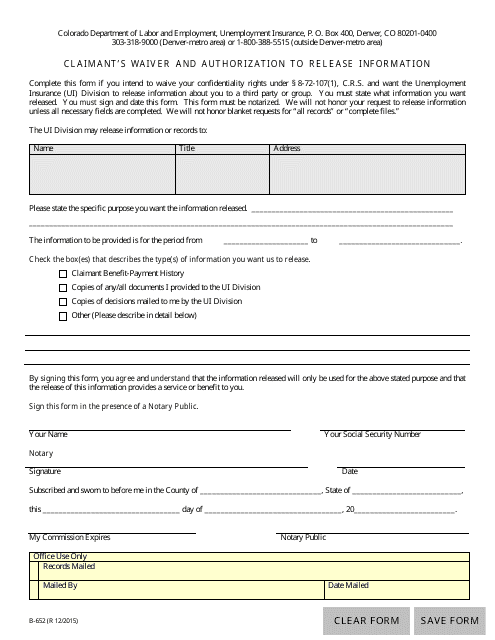

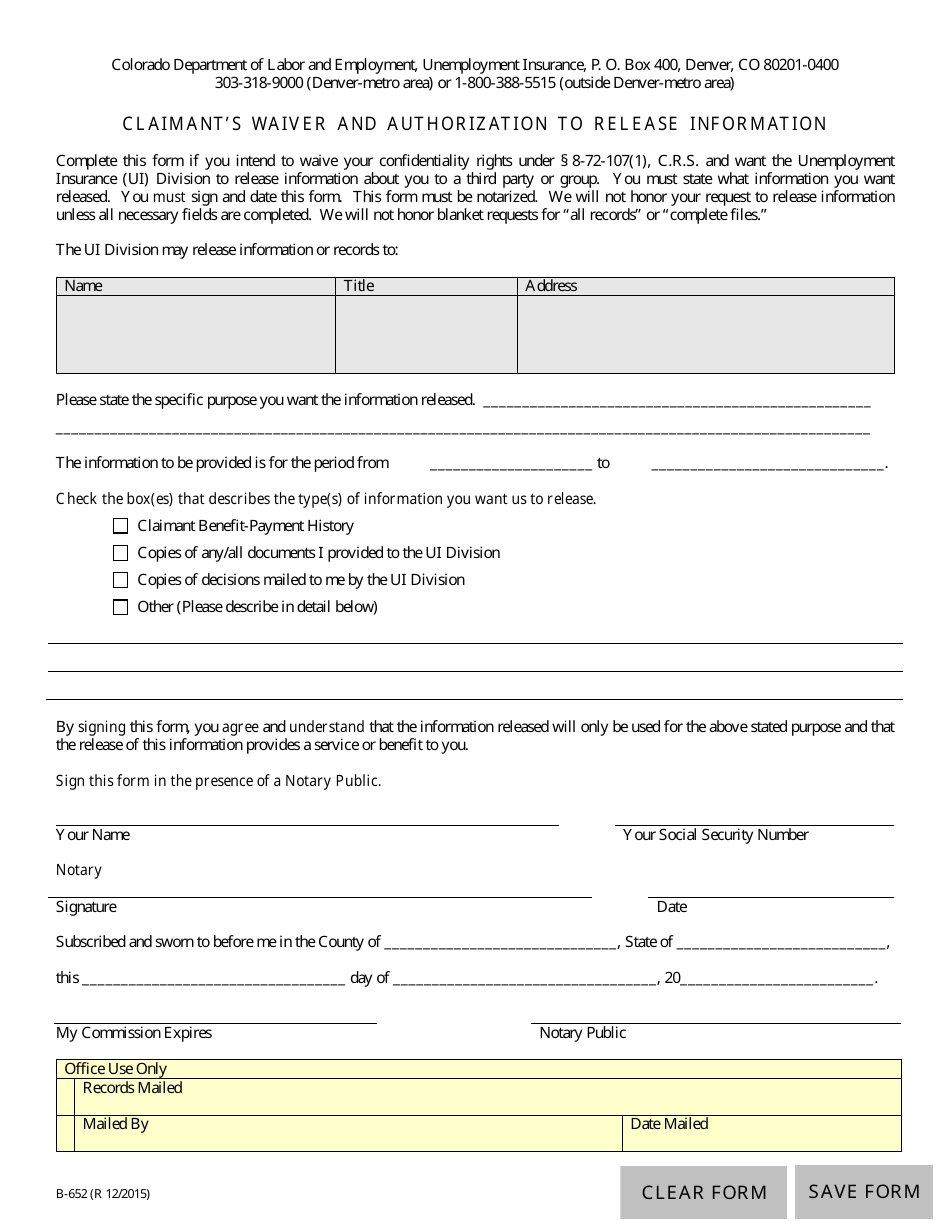

Form B 652 Download Fillable Pdf Or Fill Online Claimant S Waiver And Authorization To Release Information Colorado Templateroller

Waiver Of Statutory Requirements And Beneficiary Receipt Release 365es Pdf Fpdf Docx

Bond Waiver Pc 280 Pdf Fpdf Docx Connecticut

Free Waiver Of Notice Make Sign Download Rocket Lawyer

Illinois Quit Claim Deed Form Quites Illinois The Deed

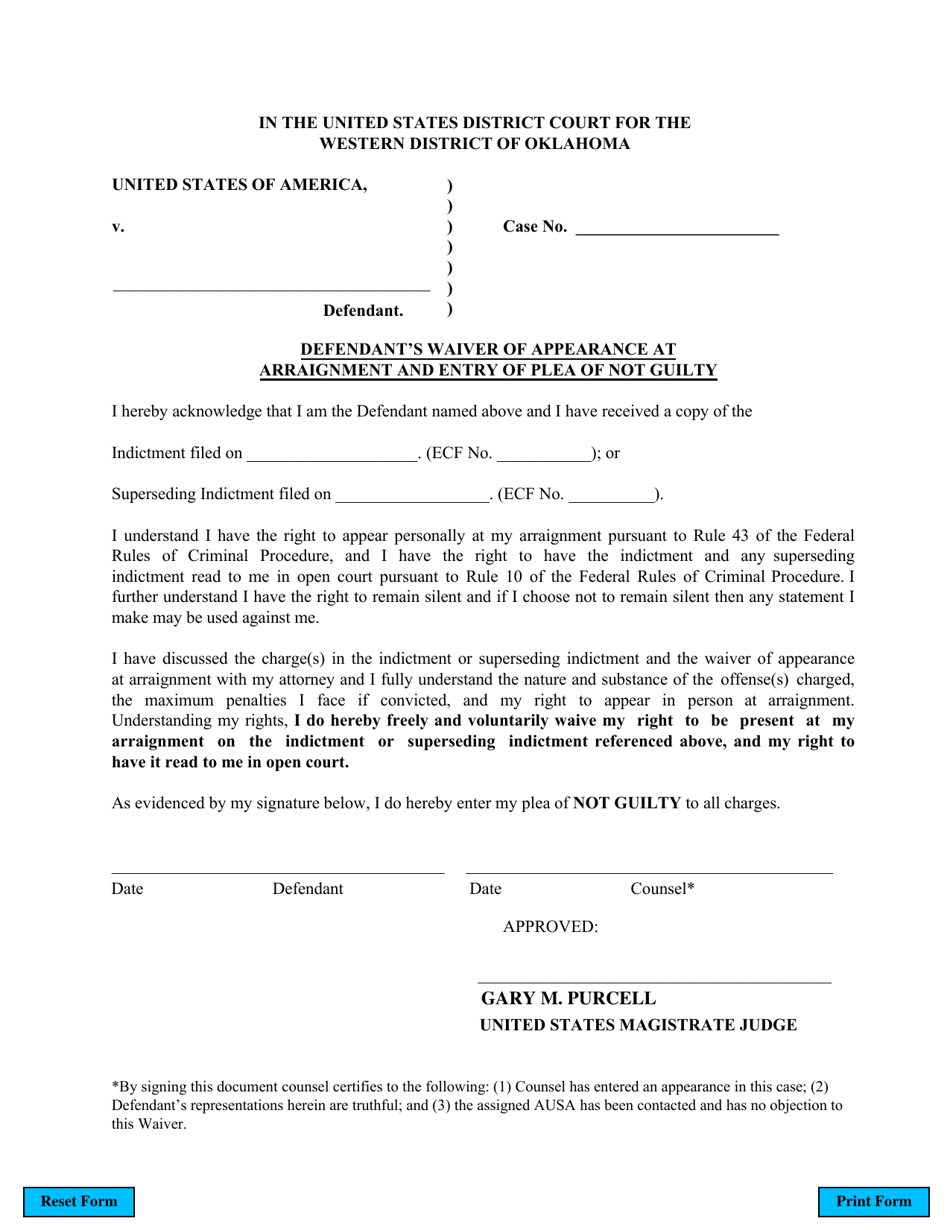

Oklahoma Defendant S Waiver Of Appearance At Arraignment And Entry Of Plea Of Not Guilty Download Fillable Pdf Templateroller

Free Saskatchewan Pasture Lease Agreement Sample Pdf 118kb 6 Page S Page 4 Being A Landlord Repair And Maintenance Lease Agreement

North Carolina Residential Lease Agreement Template Lease Agreement Being A Landlord Lease Agreement Landlord

Form B 652 Download Fillable Pdf Or Fill Online Claimant S Waiver And Authorization To Release Information Colorado Templateroller

South Carolina Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Waiver Of Priority Consent To Appointment Of Personal Rep And Waiver Of Notice And Bond Single

Free Activity Release Of Liability Template Rocket Lawyer

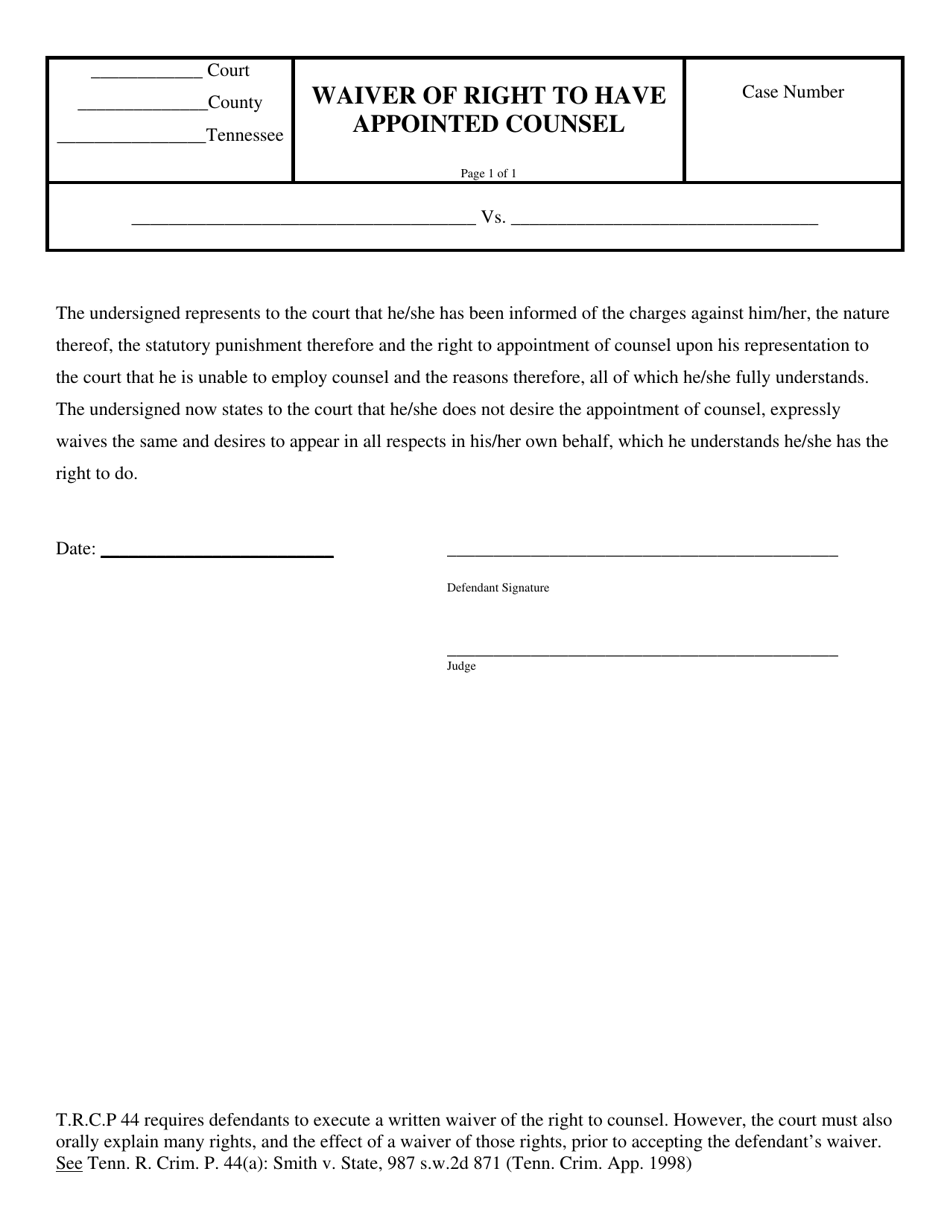

Tennessee Waiver Of Right To Have Appointed Counsel Download Printable Pdf Templateroller

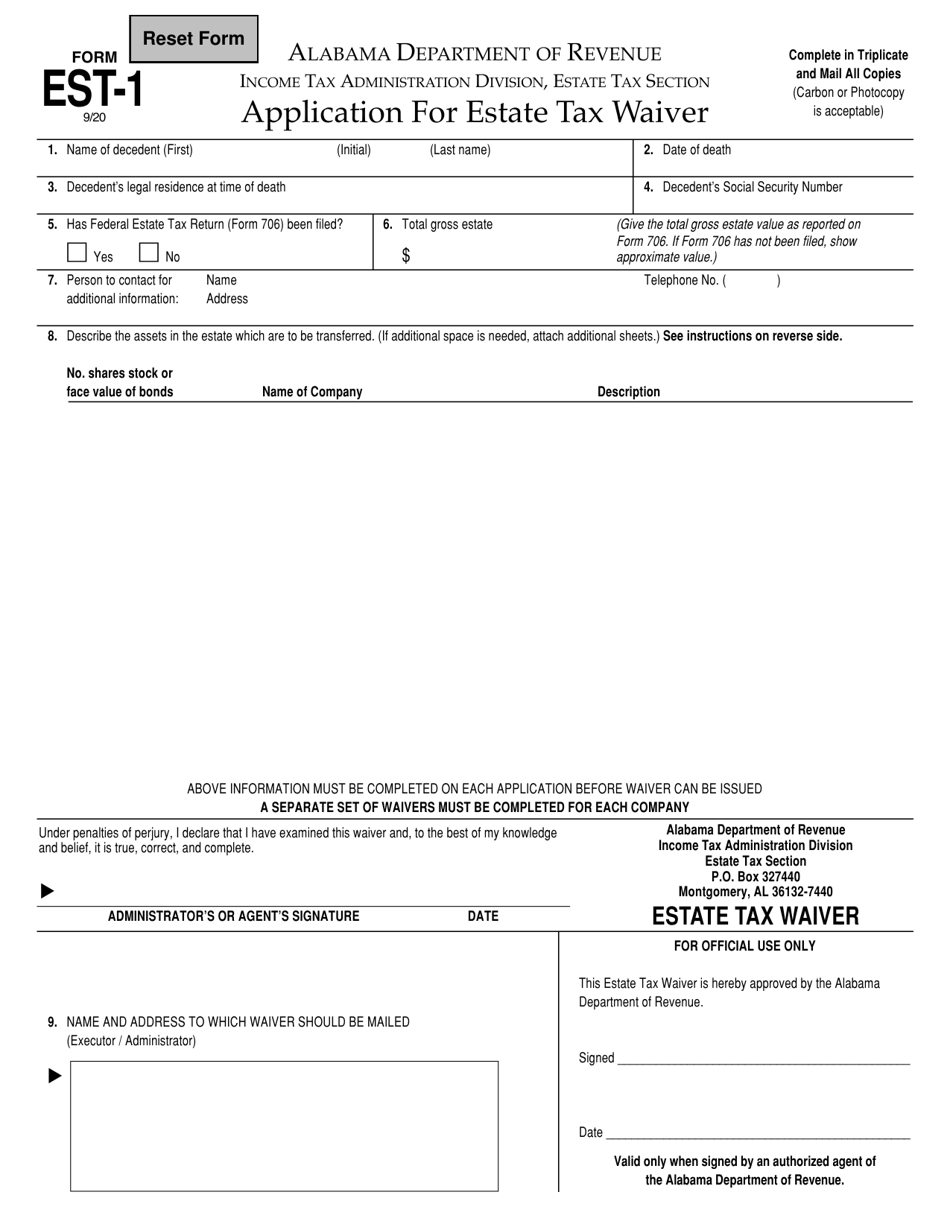

Form Est 1 Download Fillable Pdf Or Fill Online Application For Estate Tax Waiver Alabama Templateroller

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms