minnesota unemployment income tax refund

Minnesota Department of Revenue Mail Station 5510 600. If you received unemployment in 2020 and filed BEFORE Minnesota changed their law of taxing the unemployment income you may be getting a letter informing you that you will be receiving an additional refund.

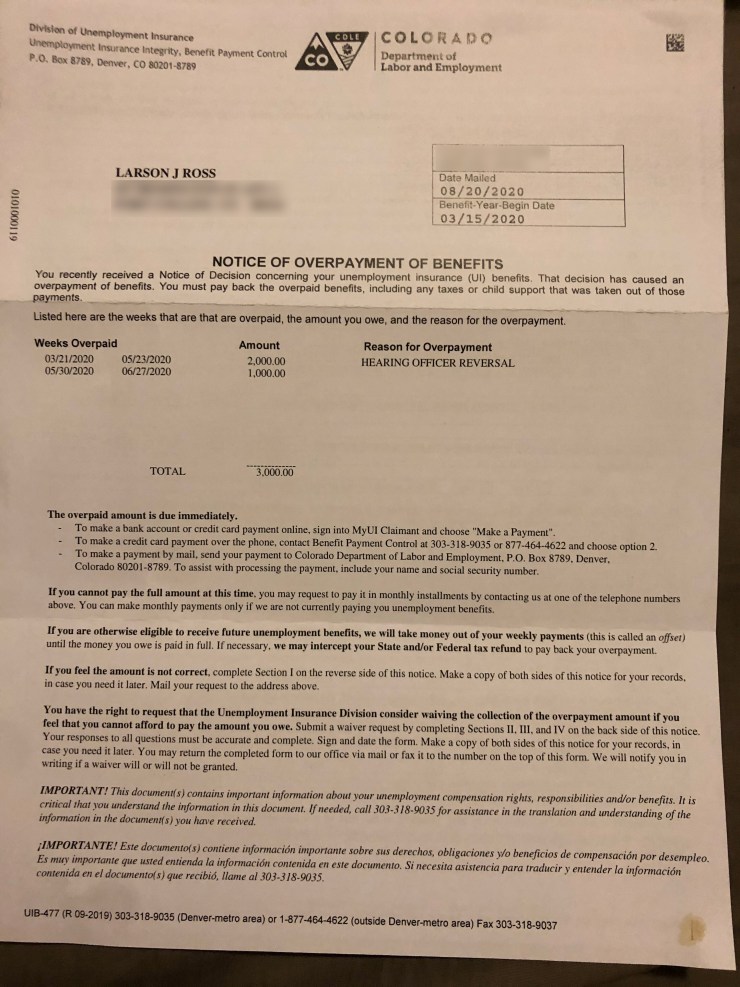

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

The Taxable wage base for 2022 is 38000.

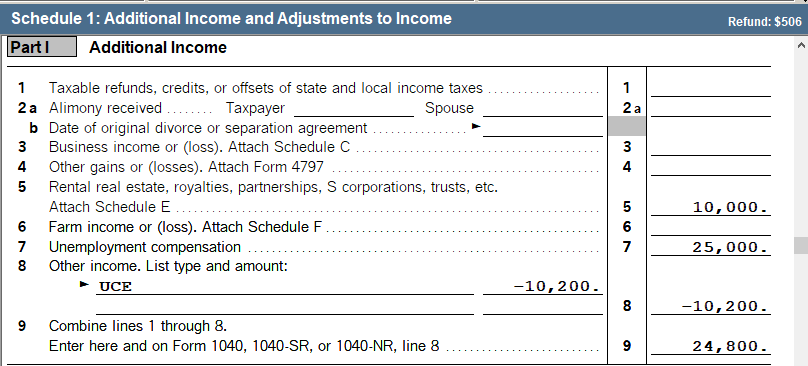

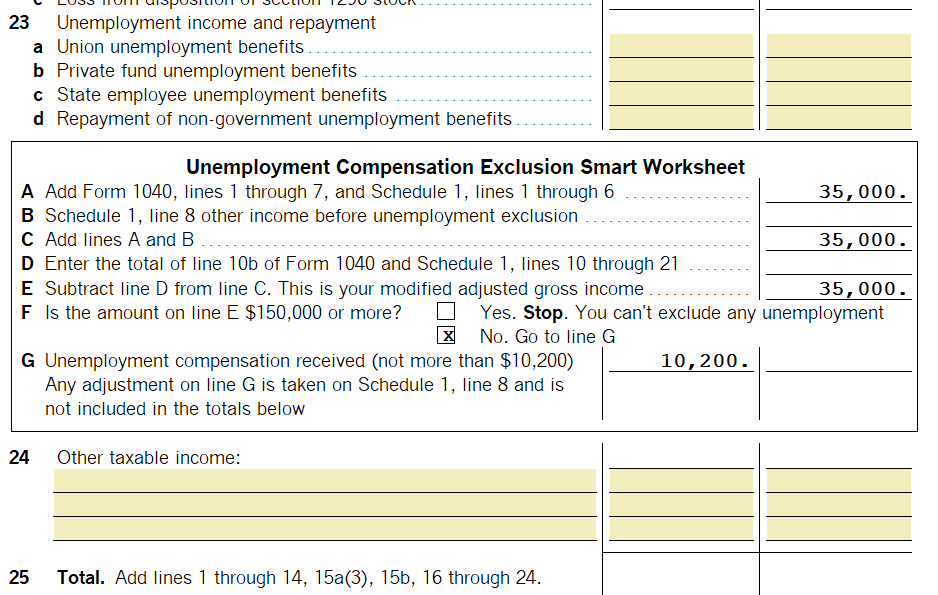

. Up to 10200 of extra unemployment benefits are also tax-free for people making less than 150000 per year. As of January 27 2022 we have. The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income.

But a lot of people still. They have about 540000 refunds to issue and expect to do 1000 per week so it may take a while. Earlier this month Minnesota tax code changes were signed into law with a focus on unemployment compensation Paycheck Protection Program PPP loan forgiveness and other retroactive provisions affecting tax years 2018 through 2020.

The website also states that they sent letters to taxpayers that need to amend their state return. On September 13th the. 375 on up to 68200 of.

Paul MN 55145-0020 Mail your tax questions to. The amount of tax reduction available to an eligible employer between july 1 2016 and june 30 2017 will be a dollar amount equal to the ratio of taxes they paid in 2015 to the. If you received unemployment benefits in Minnesota before 2021 you can also view your previous 1099-G forms.

Rhode Island taxes unemployment compensation to the same extent that its taxed under federal law. Minnesotas divided Legislature has agreed to provide nearly 1 billion in tax relief over the next four years focusing on businesses that received federal payroll loans and workers who collected unemployment checks during the COVID-19 pandemicThe final agreement also extends tax credits for preserving historic buildings and film production in Minnesota while. The state of Minnesota had originally taxed the full amount of unemployment that you received in 2020.

Minnesota Department of Revenue Mail Station 0010 600 N. The new law reduces the. Are the IRS economic impact payments included in household income for the Minnesota Property Tax Refund.

Call the automated phone system. HUNDREDS of thousands of households in Minnesota will get tax refunds worth an average of 584 each by New Years Eve. Unemployment EIDL PPP Loan Forgiveness and More.

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. If you received unemployment in 2020 the federal government decided up to 10200 of that money would be tax free to help people out during the pandemic. Minnesota Law 268044 Subd1.

In the year of repayment you may take a miscellaneous itemized deduction for ordinary income items such as unemployment on line 24 of your Schedule M1SA Minnesota Itemized Deductions. For more information on this new law refer to Unemployment tax changes. About 500000 Minnesotans are in line to get.

The amount of tax reduction available to an eligible employer between July 1 2016 and June 30 2017 will be a dollar amount equal to the ratio of taxes they paid in 2015 to the total amount of taxes all eligible employers paid in 2015. Adjusted about 540000 Individual Income Tax returns and issued refunds to taxpayers affected only by the UI and PPP changes. Employers with an active employer account must submit a wage detail.

Minnesota Department of Revenue Mail Station 0010 600 N. Special Assessment Federal Loan Interest Assessment for 2022 from 180 to 000. What are the unemployment tax refunds.

This handbook is based on current UI legislation. Minnesotas Tax Bill Update. Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically.

- The Minnesota Department of Revenue announced today that the processing of returns impacted by tax law changes made to the treatment of Unemployment Insurance compensation and Paycheck Protection Program loan forgiveness will begin the week of September 13. Reports must be received on or before the last day of the month following the end of the calendar quarter. Why are you getting this.

For taxable year 2020 Minnesota tax law now allows the same unemployment income exclusion as federal tax law. Base Tax Rate for 2022 from 050 to 010. Minnesota Department of Revenue Mail Station 0020 600 N.

The amount will be posted to the employers unemployment insurance account as a credit on July 1 2016. Mail your income tax return to. Weve finished adjusting 2020 Minnesota tax returns affected only by law changes to the treatment of Unemployment Insurance UI compensation and Paycheck Protection Program PPP loan forgiveness.

State officials say refund checks should start going out this week to roughly half-a-million Minnesota taxpayers who filed returns before the legislature passed a law affecting COVID unemployment insurance benefits and businesses Paycheck Protection Program payments making them exempt from Minnesota income tax. The Minnesota Department of Revenue has confirmed the processing of returns impacted by recent tax changes for those who collected unemployment insurance compensation and Paycheck Protection Program loan forgiveness. Additional Assessment for 2022 from 1400 to 000.

It is estimated that more than 540000 Minnesotans are eligible for the COVID-19 tax refunds as a result of these tax cuts passed in. September 13th 2021. State Taxes on Unemployment Benefits.

Tax refunds are starting to go out Monday for Minnesotans who collected unemployment insurance or businesses that received federal loans during the height of the COVID-19 pandemic. The Minnesota Department of Revenue is issuing the checks for taxpayers who paid state tax on unemployment benefits. How they affect you.

A spokesman for the Minnesota Department of Revenue said taxpayers dont need to. View step-by-step instructions for accessing your 1099-G by phone. Paul MN 55145-0010 Mail your property tax refund return to.

Mail your income tax return to. State Income Tax Range. These payments are considered a.

FOX 9 - Minnesota will take weeks or months to refund taxes paid on unemployment benefits and COVID-19 pandemic-related business loans. As far as Minnesota is concerned per the Minnesota Department of Revenue website they have started processing refunds this month. On september 13th the state of minnesota started processing refunds to those that had paid income tax on the first 10200 on their unemployment income.

Unemployement Benefits Are This Payments Taxable Marca

Unemployment Tax Break Update Irs Issuing Refunds This Week Kare11 Com

State Income Tax Returns And Unemployment Compensation

Generating The Unemployment Compensation Exclusion In Proseries

Generating The Unemployment Compensation Exclusion In Proseries

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Minnesota Tax Forms 2021 Printable State Mn Form M1 And Mn Form M1 Instructions

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

I Owe Minnesota Unemployment Compensation For An Overpayment Can Bankruptcy Help Walker Walker Law Offices Pllc

Unemployment Compensation Are Unemployment Benefits Taxable Marca

Unemployment Tax Break Surprise 581 Checks Paid Out To 524 000 Americans In Time For New Year S Eve Marca

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

Where S My Refund Minnesota H R Block

What You Need To Know About Unemployment Tax Refunds And When You Ll Get It

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Mn Department Of Revenue Will Begin Sending Tax Refunds For Ppp Loans And Extra Jobless Aid In Next Few Weeks Wcco Cbs Minnesota

Unemployement Benefits Will I Get A Tax Refund For This Benefit Marca

Surprise Checks Of 584 Going Out To More Than 500 000 Households Before New Year S Eve Do You Qualify